Moderator: Rory Curran, Rory Curran Consulting

Expert: Chris Baigent-Reed, Jigsaw Tree Ltd

Twenty adviser firms attended the two sessions; 100% offered wealth management services with approximately 30% advising on group schemes/employee benefits as well.

Use of CRM/Back Office application to support their propositions was as follows:

Notes: One firm was using both Intelligent Office and XPLAN

Every person was asked to make a round-the-table contribution so the conclusions are based on input from all attendees.

The market needs advice-driven technology to engage with a broad range of client preferences

It is felt that most technology was originally designed with a product rather than advice-focus. Consequently, it is disjointed with a high cost to the work involved in gap-filling and ultimately not client-friendly.

There was a discussion about the choice firms need to make between best of breed and integrated.

There is a need for technology to address the requirements of a more diverse consumer market place. Clients have different preferences (for example, generational preferences) and these need to be catered for. A comparison was made with the travel industry, which has seamless technology to enable advisers to offer both bespoke and self-service options.

Other points raised:

- Many sectors accept digital signatures so why are signatures in wet ink still required in financial services? This seems to be a regulatory issue to address.

- There is no technology to efficiently manage Group Risk/Healthcare.

Client portals are not universally understood

Client portals were explained. Some are integrated with back office systems (providing clients with access to data held on those systems); some are standalone (i.e. MoneyInfo) which link to the back office and other data feeds. Clients can enter/update data themselves (i.e. property and other assets). Advanced portals also provide secure messaging and document storage.

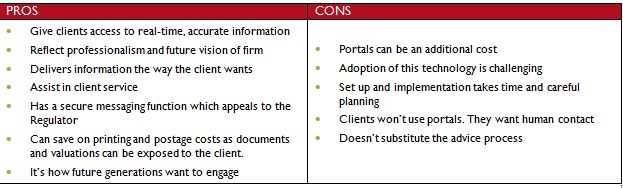

Whilst everyone was aware of the existence of client portals, there was a difference of opinion on the benefits portals deliver. The main points were:

Has there been a major shift in market share in back office technology market?

Of the 20 firms who attended the sessions:

- 11 use Intelliflo Intelligent Office

- 7 use IRESS Adviser Office, with 5 planning to migrate to IO in near future

- 2 use IRESS Xplan (one of whom also had iO implemented in their business)

- 1 was implementing Benchmark Capital

If this is an accurate reflection of the broader market (which it might not be), then Intelliflo is winning significant market share from IRESS (Adviser Office has historically been the dominant system in this market sector).

Migrating systems has to be managed carefully

A number of users had moved systems with mixed experiences. It was generally agreed that success depends on the planning (‘onboarding’) process prior to data transfer.

There are a number of key areas which any business looking to transition systems must focus on in order to get the best outcome from this process.

- There must be a clear understanding of the key business processes that require mapping into the new chosen technology. Preparation prior to any configuration workshops is crucial in order to ensure the workshops build the processes, rather than it becoming a discussion day. Consider mapping tools that can help with this process and spend time prior to the transition to get this right. A recommendation of simple technology that can support this part of the process is http://www.engageprocess.com.

- Data is the bedrock of the business and making sure it is as accurate as possible prior to migration and any post-migration cleansing is undertaken promptly, is critical in the project reaching a successful conclusion. Consider having a database assessment prior to the transition in order to truly understand the condition of your data and conduct cleansing. Furthermore, making sure you have left sufficient time in order to check the data prior to going live in your new solution, is a must do piece of planning.

- Training and Configuration – work with your chosen technology partner in creating the plan for change. Review the implementation plan with all its milestones and actions and identify the core people resource in your business, who will be responsible for driving this change. Be tenacious in your approach and adopt your one best way of operating. Use technology as a catalyst for the right changes in your business.

Managing processes and data accuracy are essential to get the best out of technology

Understanding the quality of your data is really important not just to the day to day running of your business, but also for your future exit plans in order to maximise the value of your business. The data that resides in your systems can be reused through the integrations you have in place. How often do you check the integrity of that data? More Financial Advice businesses are looking at how they can complement the services they already provide to their clients through a digital engagement, those firms need to be confident that the data they share is accurate. Use management information to review your data accuracy and agree a standard data set that is entered per client to have consistency of entry across your client bank.

Any business with any technology needs confidence that the way it’s being operated is optimised through the processes that are embedded within it. Often a process is being operated in a certain way “because it always has” look for better and more efficient practices. Review what you are doing for consistency and streamline where possible.

Set up integrations to make sure that data can be reused or have data feeding into your database from other sources so that manual intervention can be avoided where possible, along with duplication of effort. Look for the key integrations that will provide maximum value.

Ross Wilson of Benchmark reported that Origo is working on a data warehouse project to enable greater access to historic policy/plan information, such as contribution histories. Standard Life, Aviva and Cofunds are the most advanced providers.

Key Learning Points

- Review your future strategy, along with that of your technology provider to ensure you have a clear understanding and are aligned.

- Look at what services are provided by your technology provider in order to maximise use, (on line training, workshops, user groups, conferences, training workbooks) drive adoption and improve return on investment

- Consider how efficient your processes are, when did you last review them? Is it time to review these for consistency and efficiency?

- If transitioning to new technology, start with the end in mind and work backwards to ensure any live dates are realistic and that your specific objectives can be achieved.