Centralised retirement propositions – the growing need for a decumulation strategy

Experts: William Marshall, Hymans Robertson

Facilitator: Richard Parkin, Independent consultant

State of play

Pension freedom has resulted in significant growth in the drawdown market. Statistics from the FCA released at the end of September show £28bn (before tax-free cash) moving into drawdown arrangements in the year to 31 March 2020. Around a third of these cases were for clients with over £100,000 in drawdown and 80% of these larger cases were advised. This growth has required advisers to look again at how they manage retirement advice and spawned another acronym, the CRP or Centralised Retirement Proposition.A recent report on retirement advice defined a CRP as:

‘A common and consistent approach to retirement advice that is followed by the whole firm and will typically cover investment and withdrawal strategy but may also extend into fact finding, assessing attitude to risk etc.’

The report found 43% of advisers have a CRP with another 16% saying they will establish one in 2020. Our discussion centred on two important aspects of a CRP – decumulation investment strategies and assessing clients’ life expectancy or longevity.

Decumulation investment strategies

Assessing portfolios for accumulation typically involves focusing on expected risk and return. However, when considering decumulation portfolios, Hymans Robertson propose additional factors need to be considered:

- Sustainable withdrawal rate: the level of income the portfolio can reliably support

- Sequencing risk: the risk that poor performance in the early years of retirement results in savings being depleted faster than expected

- Liquidity: the ability to realise assets to meet income payments when needed

- Extreme risk: looking beyond standard volatility to assess worse case scenarios.

Hymans believe this means decumulation strategies should focus not just on diversification between asset classes but also consider volatility within asset classes, the quality of investments (especially credit) and the ability to support income withdrawals. By doing this, advisers can build robust portfolios that both generate the required returns but also manage the timing and predictability of these returns.

Longevity

For those needing to draw down on capital to support income payments, it is crucial to understand how long payments are likely to last. Hymans Robertson’s sister company Club Vita specialises in assessing longevity drawing on mortality information from around a quarter of UK defined benefit schemes.Drawing from this data, our speaker demonstrated how standard ONS mortality data can often underestimate individual mortality due to its focus on average life expectancy and not including expected mortality improvements. By assessing longevity using factors such as postcode, affluence, health and vocation, one can find differences in longevity of 10 years or more between clients in the same region.Hymans suggested that, by combining the uncertainty of longevity with uncertainty of investments, advisers can build a much clearer picture of retirement outcomes and so build more robust retirement plans for their clients.

The discussion

Investing in retirement

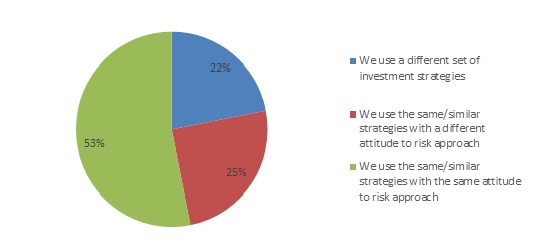

We asked participants how they invest their clients’ retirement assets, particularly the extent to which they use different funds or a different attitude to risk approach.

Figure 1: Do you use different investment approaches for decumulation and accumulation?

Those using the same portfolios and ATR approach tended to move clients to lower risk portfolios as they went into decumulation. A number of advisers felt that overall attitude to risk doesn’t really change but rather capacity for loss should be the focus. All were keen to emphasise the importance of planning and measuring outcomes against client goals. Cash flow planning is widely used with several advisers also using scenario analysis to support client conversations.

Many advisers are still looking at annuities, especially for smaller pots, if only to demonstrate the option had been considered. Beyond this, the use of cash buffers seemed to be the most prevalent way of managing sequencing risk though there was a recognition that this still leaves a decision as to when and how to top cash up. Some were following the “bucket” approach of allocating client assets between short, medium and long-term portfolios but were still left with the issue of how and when to rebalance between portfolios.Advisers were keen to emphasise how retirement planning needs to consider all assets, not just pension. By diversifying across different sources of income advisers can better manage the risk of a market downturn. Another key approach in managing sequencing risk was a dynamic approach to taking income. Following the downturn, several advisers had suggested clients turn off income if they didn’t need it thus avoiding selling assets at depressed prices. This was made easier by the fact that many clients were spending less due to lockdown restrictions but may be a less viable approach under different circumstances.

We asked advisers to tell us what they saw as their biggest investment challenge for retirement.

Figure 2: What is the biggest investment related challenge you anticipate over the next three years?

This underlines the task facing advisers. Generating returns that support retirement plans will become more challenging and the market environment will likely be more volatile, increasing risks of achieving goals. Identifying portfolios and investment solutions that can deliver the required returns withing acceptable risk levels will be key.

Assessing longevity

We asked participants whether they assessed longevity at an individual client basis.

- Figure 3: Do you assess individual client longevity when constructing a retirement plan?

There were several reasons given for why longevity might be unimportant:

- Clients have sufficient assets to meet their income needs in perpetuity

- Retirement planning covers beneficiaries extending the planning horizon beyond the client’s own lifetime

- Some clients might be looking to withdraw assets before death.

A number of advisers suggested that they would deliberately not consider drawdown if there was a likelihood that the clients could ever run out of money so assessing longevity was not relevant. Others highlighted the reduced need for income in later life and so strategies that involved running down capital during retirement were perfectly valid but again meant that longevity was less relevant.Those who took a more selective approach tended to assess longevity when clients had specific medical issues or a family history of certain conditions. Many used the standard ONS tables while some used online tools though recognised these did not really focus on some of the individual risk factors Hymans had highlighted.Again, using cash flow modelling was a helpful way for advisers to introduce the issue of longevity though there was a feeling that these tools didn’t always allow adequately for income to beneficiaries.

Conclusion

The rapid market recovery post the initial Covid-induced market correction has perhaps mitigated the challenges faced by drawdown investors. Moreover, reduced spending needs have made it easier for clients to reduce income withdrawals. Going forward, the environment may be more challenging. The prospect of lower nominal returns combined with increased market volatility will make it more difficult to meet client objectives.Helping clients understand and manage retirement risks will be more important than ever. Use of cash flow planning and scenario modelling are already growing. Hymans believes that, by combining longevity and investment risk, advisers can give clients a more detailed and complete view of potential outcomes. Demand for investment solutions that are specifically designed for retirement is only likely to grow as meeting client objectives becomes more challenging.