Business leaders forum- what does today’s uncertain economic landscape mean for business strategy?

Expert: Dr Peter Westaway, Chief Economist and Head of Investment Strategy, Europe, Vanguard Europe

Facilitator: Rod Bryson

Session summary:

Our expert Dr. Peter Westaway introduced the session by covering four main points:

- Where do we stand with the global pandemic? As we all know it’s had a massive impact on the Global Economy and on our businesses, even though not so much on our industry as others.

- What are the immediate prospects for economic recovery?

- What are the long-term implications of the pandemic?

- What does this mean for how people will invest in this new world?

1. Where is the UK with the pandemic?

Globally the number of deaths are getting worse and worse. Asia and Australia got on top of the pandemic quicker than everyone else. Then we have Europe and US with their multiple waves, still trying to control the pandemic with various lockdown strategies and lastly Latin America that has been greatly affected due to the inability to enforce lockdown measures.

What we need to remember is that whatever is happening to UK and our ability to recover and go back to an open global economy is going to be constrained by the whole world getting rid of the virus and not just us.

However, there’s been good news about the vaccines so far so the prediction is that the economy should start recovering mid-start of 2021.

There are 3 main factors affecting how we recover from this:

- How far away is the economy away from what people call herd immunity? Basically 70% of the population need to have been vaccinated or had the virus.

- The reticence gap needs to reduce too. People are reluctant to go out and spend money, this doesn’t affect the way people are investing but it does affect businesses, people’s jobs…We are 10% below where we thought we would be at this stage. 10% is a huge number, the scale of the downturn has been enormous.

- The output gap.

While the market responded very well to the news about the vaccines, the next three months growth is going to be negative so we are basically having a double dip recession.In the long run, having a lockdown should mean the economy will recover quicker. (Eg. China, Australia)

High frequency data suggests the UK economy was already running out of steam before the national lockdown was imposed (from August- November).

2. Economic scenarios for 2021 for UK economy

- The immunity gap will close by mid-2021. Herd immunity achieved by people taking the vaccine even if there are question marks about everyone feeling comfortable about taking it. We actually only need 60% as it’s estimated that 10-15% of the population have developed some sort of immunity from being affected by the virus.

- That is the baseline scenario where we get to some sort of normality by mid-2021 or at least people start spending money again, unemployment will go down, inflation will start moving back to target and the UK economy will roughly go back to the level of output at the end of 2021. So, it’s a long haul.

- It could be better if government is very successful at rolling out the vaccine quickly however it could also be worse.

There are 2 different parts to focus on this graph:

- We’ve had the sharpest fall in GDP in 300 years and the fall in March was the sharpest fall ever.

- Then we had a proactive recovery.

- But the 2nd wave brought a new fall.

- But we can see a much sharper recovery coming next year until we get to a new normal.

The key here is “New” Normal:

- This will not be the pre-pandemic normal. It is believed that activity will be permanently lower.

- Businesses have been knocked out and those are not going to come back quickly. There will be a period of scarring (1-2% lower than it was).

- Also, what is the nature of activity in this new normal?

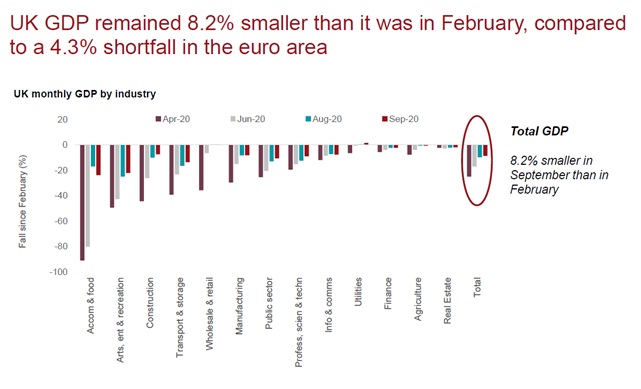

- The sectors that took the worst hit have been those that are predominantly face-to-face.

- Industries like ours and the public sector were relatively unaffected. Manufacturing and construction were hit a bit but have bounced back.

- So, thinking about that in terms of your client base, people that are going to be investing with us, there are going to be certain sectors of the economy who are going to be struggling to put money into their accounts.

- But we are also going to see other people saving a lot more than usual, the money they would typically be spending on holidays, etc….

- There will be the winners and the losers

3. The policy environment and how is this going to affect how people invest and the economy.

The two elements affecting us all at the moment are monetary policy and physical policy.

Low interest rates are here to stay for a long time. More broadly this means returns on assets more generally will be pretty subdued. So, for people saving for their retirement, they are going to have to get used to the idea that rates aren’t what they used to be.

There is a danger of clients being lured into more risky products that don’t match their preferences in that so called reach for yield. That is why is so important that honest conversations take place around the likely return. Less could be more. It is important to reset expectations.

The other thing is around debt. There are different ways to present debt, if you don’t want it to look too bad, you show the chart since World War II so it doesn’t look particularly high at the moment. (Bit naughty doing it that way though…) But there is a parallel as this pandemic is a one off hit and we shouldn’t try to get the debt down too quickly. The stories of taxes having to go up are misplaced. We’ll have a tighter policy going forward but let’s not forget the levels of interest rates at which governments have been borrowing are very low (if not zero).

Debts is a worry and it will have implications for taxes which will affect all of us but there is no real risk that inflation will get out of control, that is one of the things we hear a lot about.

Investor behaviour

Vanguard owns a huge chunk of US savings so they have been doing a lot of research into how investors behave during periods of market volatility.

Roughly speaking the amount that clients turn over and trade was only twice as frequent as normally would have happened.

What we have learnt from this, definitely from the US experience (but data from the UK is very similar), is that typically people haven’t put their cash under the mattress. What we have found is that those who were called cash panickers and went to cash, if you then look at their exposure by the end of the year, those who tried to time the market and bailed out were the ones who did the worst.

4. Questions:

Q: Are those Economic Scenarios widely felt across the market place and is it that what is keeping the market at the level it is considering all the other news about debt level and so forth?

A: Typically, the market anticipates the economy recovery so the market will always recover before the economy itself.The market is getting over optimistic but is basically reflecting this upside scenario. The other nuance is that one of the puzzles over the last few months is the relatively good performance of the US stockmarket compared to the European stockmarket and a big part of that is the tech stock.European market has better valuations than the US market which is a bit punchy with their valuations.

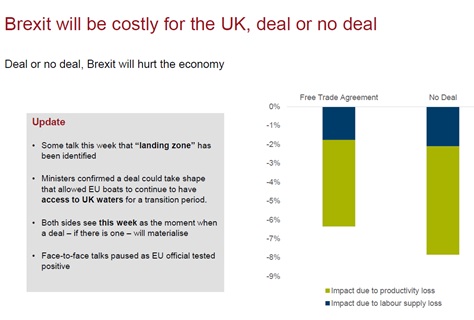

Q: How much is Brexit impacted into what has been predicted here?

A: The interesting thing about Brexit is we think so far it has had a relatively modest effect. Clearly over the past year or so, there has been a lot of uncertainty that has had a dampening impact. Whether there is a deal or not a deal and depending on the sort of deal we are going to get, we think the difference between no deal and a bare bones deal is relatively small beer compared to where we’ve been. So, we think the cost of Brexit will be between 6-8% GDP but that is over the next 5-10 year. Over the very short term, the risk of Brexit will be around the disruption at the border caused by the sudden realisation that lorries are going to have to fill in forms and there’s going to be a lot of uncertainty. So, we think the impact of Brexit is more on our downside risk and the main risk of Brexit is going to be in the longer run. The new governor of the Bank of England made a comment this week that the impact of Brexit is going to be greater than that of the Corona Virus. The reason why that is probably true is the effect of the pandemic, while gigantic, it will eventually unwind while with Brexit it is the other way round, Brexit is potentially going to have a great effect but it is going to play out over a number of years. It’s going to be a slow burning cost that is going to be harder to quantify.

Q: When we are talking about the Winners and the Losers… and the knock on impact, are those really known that yet? The knock on utilities, the knock on real estate that’s not really completely known yet.

A: No, it’s not. We’ve been talking about GDP but what is more interesting is how the world is going to change? What is it going to look like? What sectors are going to be long term winners and long term losers.One question is to what extent is remote working here to stay and to what extent is it going to snap back? The answer is we don’t know. We know the higher end jobs, professional, management or technical jobs are more easily done at home and the more manual and lower paid jobs are less, that’s why they’ve been hit harder. Again the winners and losers and the distribution of consequences is going to be long term. It is hard to tell if this remote working is going to be long term but all that initial set up cost has now taken place so it been made possible but there are also benefits to working together, so we think there’ll be more remote working in general with visits to the office from time to time. This will mean more people moving to the suburbs, spending less time commuting, all these will be gradual developments.One other big question, is this good for the economy or not? Are people productive at home? Our experience is that people are being more productive.

Q (to delegates): How have you found your clients adapting to this online/ virtual world?

A: Some of the delegates already had quite a digital advice process pre-covid, a lot of their advice journey was already digitised and over the pandemic had done the whole end-to-end process digitally. At the start there were a number of customers who needed some education on how to set things up so advisers needed to become technical experts but as pandemic has gone on and people have been dragged into zoom (eg. Grandparents now talking to their grandkids, getting more comfortable with the technology) and other things, they’ve got used to it and we find it works really well and it’s only the vulnerable clients who still ask for face-to-face as you would expect. Post pandemic it is expected that 70% will have face-to-face opportunity but at least 30% will still be digital. It is more effective and productive at the same time. However, it will never replace face-to-face. It is a case of recalibrating the balance.Advisers have also pointed out that another benefit of the virtual environment is the ability to see your clients body language as you are presenting to them results, proposals, etc… something that face-to-face is harder as you are sitting next to them or focusing on the document you are presenting, while in Teams or Zoom you can see both at the same time and this allows you to respond better to the clients’ body language. Another benefit of remote working is the lack of location barriers. Now you can pick clients from anywhere from wherever you are based, something that wasn’t financially viable in the past.

Q: There’s a desire to go back to some sort of normality but it’s going to be interesting to see how long this plays out. The Chancelor said that he thinks it will be 2024 when they are expecting some sort of normality. Is there a view of how long this will play out? We don’t know what the impact of remote working will be but we think normality will come at the end of 2023-2024?

A: There are no consensus but that time scale is realistic. It will take a long time for the dust to settle. But we need to keep in mind that changes that before took months/ years are now taking place in weeks, so…

Q: How does our debt compare to other countries?

A: Compared to the US our debt is actually low. As far as the rest of Europe, Germany are the good pupils in the class, historically and psychologically they don’t like running as much debt but they currently have to due to the pandemic. France is on a level with us. Countries like Italy and Spain run a huge level of debt as they are still in bad shape from previous crises.

Q: How does everyone see the economic impact of all this on the advice market? Is this going to change the dynamic of the wealth advice market?

A: Wherever there’s a crisis there’s a need for advice and intermediaries are very well placed to continue to run an ongoing advisory service. The more uncertainty, the more people are in need of advice. But in terms of the impact on the economy, it also depends on the level of client we are talking about. Definitely the more valuable, wealthier clients in our book with a higher level of complexity you would expect to require more advice; but overall, we’ve been amazed at the number of people addressing their financial situation over this period. We have seen record levels since March. The opportunity is very good, many junior advisers have a large proportion of clients they have never met face-to-face and who they may never meet plus we have received clients from other wealth managers who maybe weren’t as well prepared to deal with the challenges.

Q: How did end-clients react to all this market volatility and all the concerns around what they saw in the news in a daily basis? Are you seeing an increase in the calls to advisers?

A: At the start there was a great need for reassurance and teams were constantly on the phone (or zoom) but that has settled down and people have become used to the volatility. With regards to advice, we are seeing a lot more enquiries about helping families. People are thinking more about intergenerational wealth and supporting families. We are having more introductions to the family than we have ever had which is encouraging. It is a different type of business but there is definitely plenty of opportunity.